One Weather Solution for Informed Rates, Swift Claims, and Unrivaled Asset Protection

How Baron Can Help You

Gain invaluable insights into the weather to make informed decisions for your organization and clients. Our solutions eliminate the need for meteorological expertise as they deliver precise historical data and transform intricate weather forecasts into understandable and actionable data.

Thousands Trust Baron to Weatherproof Their World

The Benefits of Choosing Baron

-

Faster Validation

-

Better Risk Modeling

-

Boost Engagement

-

GIS Ready Layers

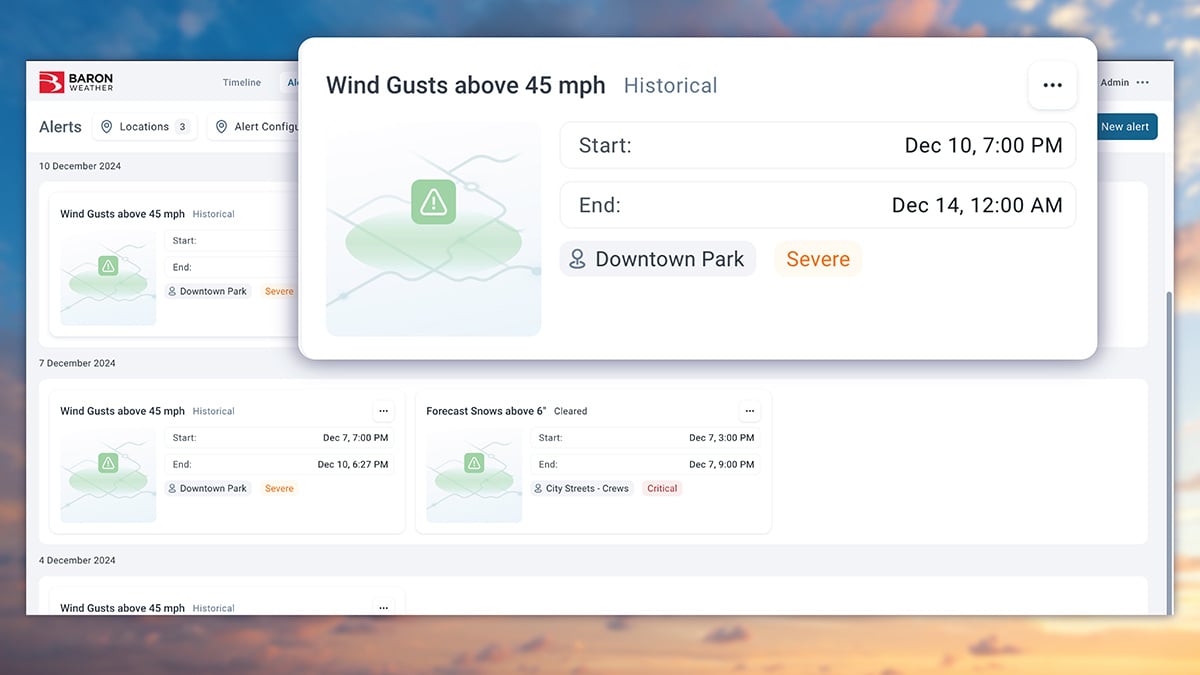

Faster Claims Validation

Evaluate policyholder claims quickly and fairly with access to historical weather data for any location up to 12 years ago. Our historical data archive ensures the accuracy of the claims assessment, reduces the risk of fraud, and allows policyholders to receive the timely assistance they deserve.

Better Risk Modeling

Our historical weather data helps you confidently understand risks and expenses associated with insurance coverage in susceptible geographic areas. Our precision data allows you to fine-tune pricing, create customized solutions, and effectively manage weather-related perils with insights into future weather patterns.

Boost Customer Engagement

Notify policyholders up to three days in advance about severe weather conditions through personalized weather alerts tailored to their location and coverage. Take a proactive approach by offering guidance on claim filing and minimizing wait times through the implementation of staffing and response strategies ahead of inclement weather.

Optimize Your GIS System

Protect your assets from the negative impacts of weather exposure by monitoring everything in one unified system. Our exclusive weather data comes in Esri-ready layers, enabling you to maximize your investments and expand operational safety.

Testing filtering based on: industries = Insurance (7)

Kristina Miller

Field Leadership/IMT

Team Rubicon

Anonymous

Risk and Recovery Manager

Emergency Management Agency

Chuck Stevens

La Plata County Manager

La Plata County

Elliot Jones

Director

Crenshaw County, AL

Jim Lemon

General Manager

KEYT

Sam Bernabe

President/GM

Iowa Cubs

Anonymous

Technical Project Manager

Government Agency

Why Pay for a Weather Solution?

Baron surpasses free sources.

Tailored for Insurance Professionals

Designed with an understanding of the decision-making pressure insurance professionals encounter daily. Your responsibilities can be daunting, from assessing risks and determining coverage options to managing claims and navigating regulatory compliance. Our solutions provide the tools and support needed to make informed decisions. Drive greater efficiency, enhance customer satisfaction, and protect profits with Baron.

Baron Weather API

/API_AdobeStock_718068621_1600.jpeg)

Unlock the power of high-quality, reliable global weather data with current, future, and historical datasets seamlessly integrated into your operations. The Baron Weather API gives businesses access to over 200 data products and 102 Baron-exclusive offerings.

ArcGIS Weather Layers

/Esri_2023.png)

Elevate your Esri solutions with seamless integration of Esri-ready data layers from Baron. Unify your assets with current, forecast, and historical weather data for real-time analysis, enhancing your decision-making capabilities.

Weather Logic

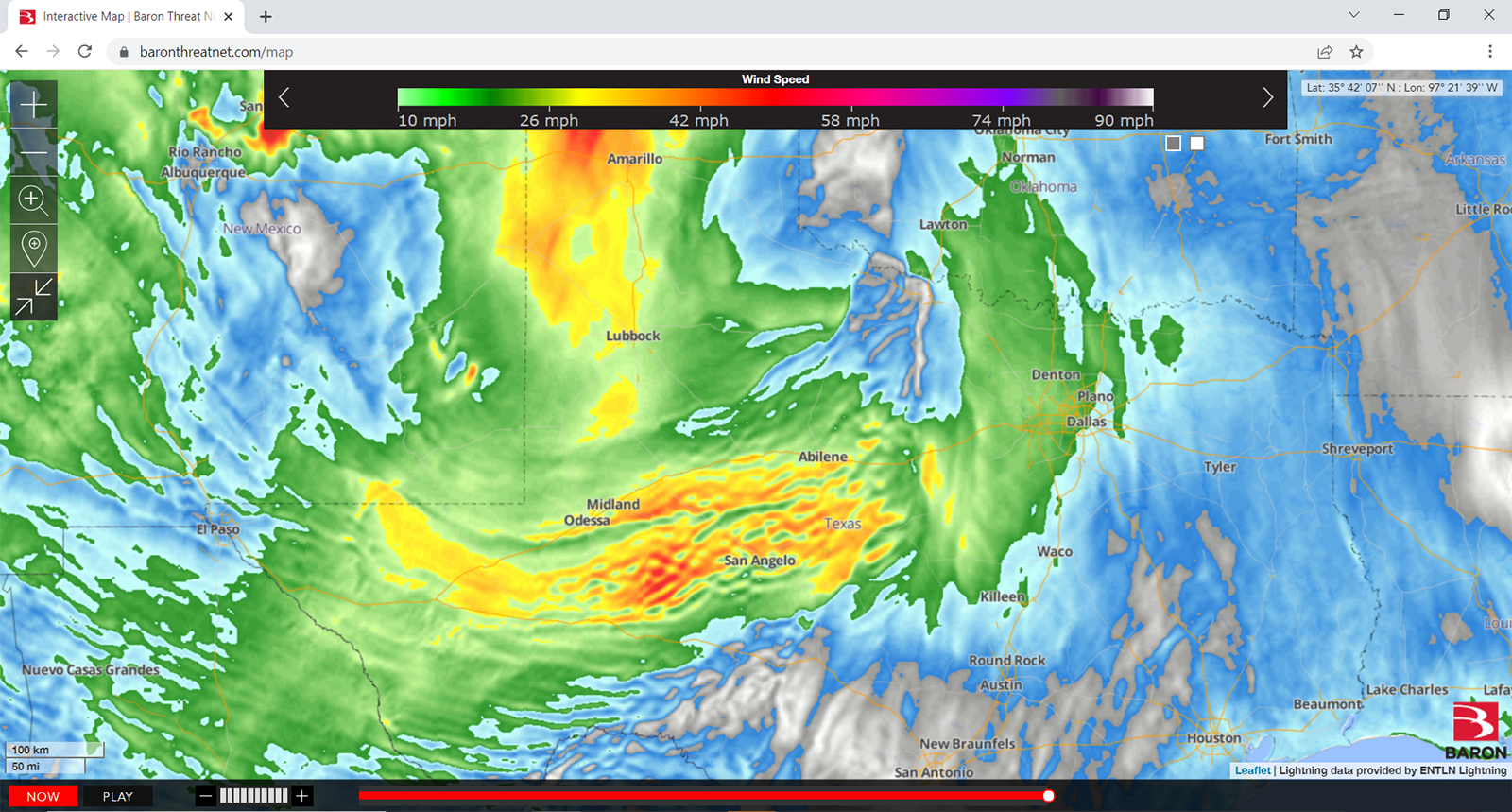

Baron Threat Net

Baron Threat Net® leverages high-quality data products at an optimal solution for live, real-time tracking of hazardous weather and short-range forecasting—all at an attractive price point.

/API_AdobeStock_718068621_1600.jpeg)

Baron Weather API

Unlock the power of high-quality global weather data seamlessly integrated into your operations with the Baron Weather API. Designed to accommodate all programming languages and data formats, our API offers access to a comprehensive data catalog featuring over 200 products including current, forecast, and historical data and 102 Baron exclusive offerings.

This robust suite empowers industries to make informed, data-driven decisions, enhancing efficiency across the board. The Baron Weather API is your gateway to smarter weather data, providing valuable insights for a diverse range of applications and industries.

/Esri_2023.png)

ArcGIS Weather Layers

Elevate your Esri solutions with seamless integration of Esri-ready data layers. Unify your assets with current, forecast, and historical weather data for real-time analysis, enhancing your decision-making capabilities.

Visualize the weather data alongside underlying data layers on a unified platform to gain valuable insights that maximize the efficiency of your investment in the Esri ecosystem. This consolidated approach ensures location-specific GIS-formatted weather data is easily accessible, promoting informed decisions and increased operational efficiency for a comprehensive, streamlined experience.

Weather Logic

Weather Logic™ is a cloud-based decision support tool that simplifies your decision-making. This all-in-one solution assesses weather impacts and provides the critical "tap on the shoulder" needed through custom weather alerts to save time, reduce costs and improve safety.

Our user-friendly tool is suitable for organizations of any size and features customizable alerts, timelines, interactive maps, and intuitive dashboards. This easy-to-use weather and GIS platform seamlessly integrates maps and relevant asset data. Weather Logic strengthens users' ability to make informed weather-related decisions, offering a versatile and efficient solution across various industries.

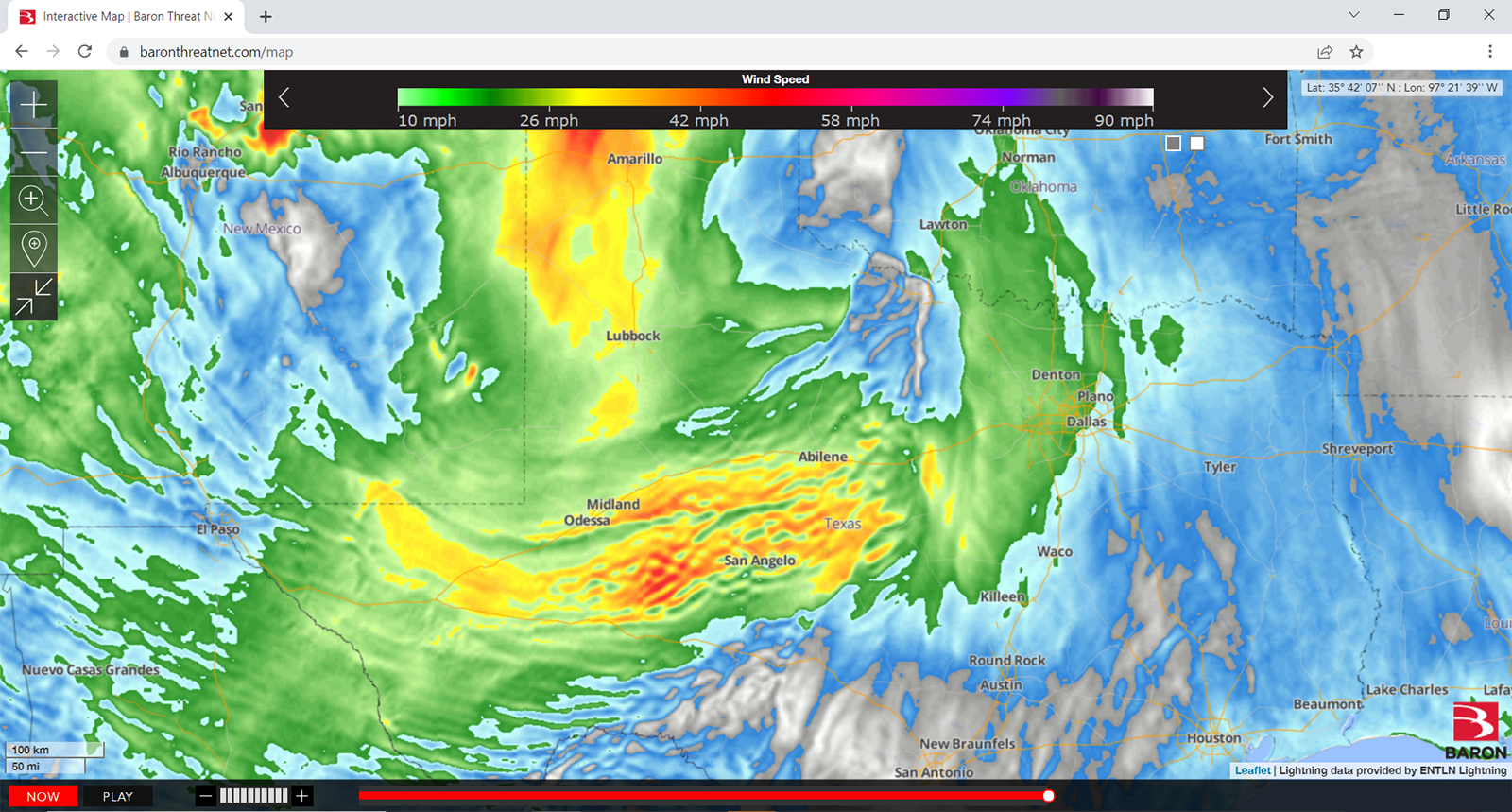

Baron Threat Net

The foremost weather monitoring and storm tracking platform Baron Threat Net® presents an optimal solution for live, real-time tracking of hazardous weather conditions and short-range forecasting—all at an attractive price point.

Leveraging Baron's high-quality data products, this platform delivers current, forecast, and historical data, enhancing decision-making in critical situations. With its proven weather data, Baron Threat Net is a comprehensive, trusted solution, offering essential information to fortify preparedness and response efforts when it matters most.